In the dynamic landscape of electric vehicle (EV) technology, the quest for sustainable and efficient battery solutions has reached a critical juncture. Amid the surge in EV adoption, the intricate supply chain for battery production faces new challenges, notably underscored by the escalating U.S.-China trade war. While conventional recycling efforts have primarily focused on recovering metals like nickel and cobalt from spent lithium-ion batteries, an often-overlooked mineral has emerged at the forefront of the discourse — graphite.

As the trade tensions intensify, and the Biden administration imposes restrictions on semiconductor exports, concerns have arisen about securing the materials essential for anode manufacturing outside of China. Graphite, traditionally treated as a byproduct in recycling processes, is now gaining prominence. The implementation of new federal tax credits, rewarding automakers utilizing domestically sourced minerals, aligns with this shift in focus. Explore how the intersection of geopolitical dynamics, trade policies, and the growing demand for EVs is steering the U.S. auto industry towards exploring innovative solutions, particularly the potential of recycling graphite from spent batteries, to forge a sustainable path forward in the evolving EV revolution

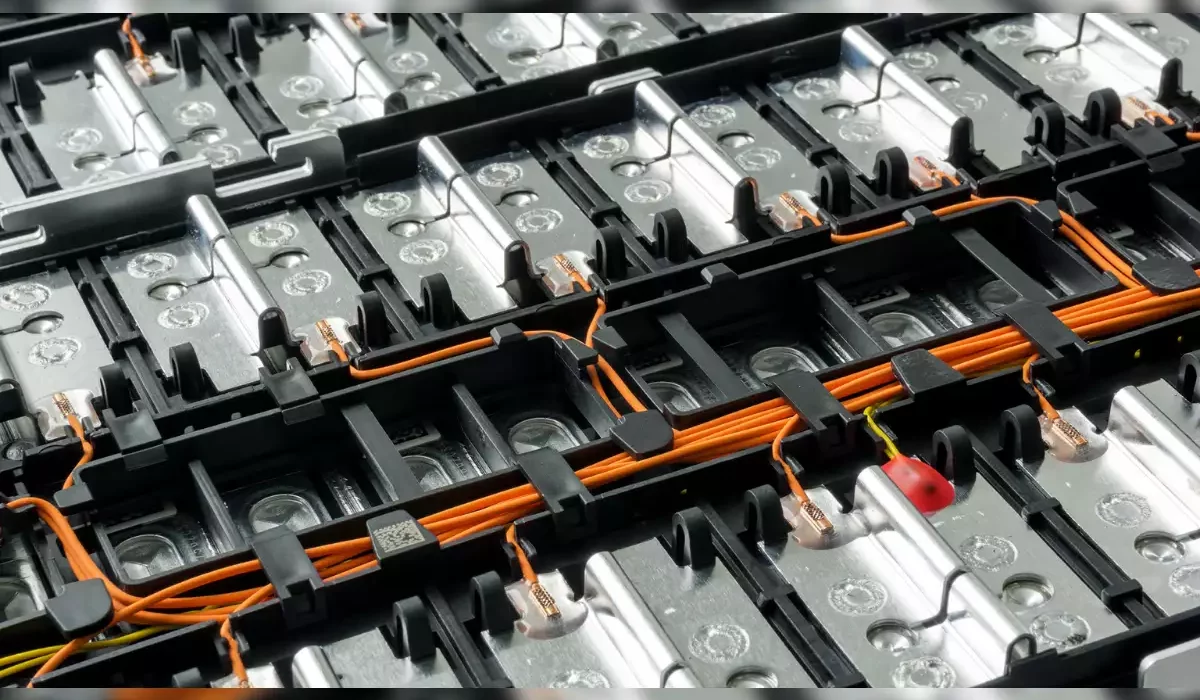

The Overlooked Mineral: Graphite in EV Batteries

As electric vehicles (EVs) gain widespread acceptance, the race for securing materials vital to EV battery production intensifies. While the focus has been primarily on recovering metals like nickel and cobalt, recent developments in the U.S.-China trade war have brought attention to an often-overlooked mineral: graphite. This article explores how the escalating trade tensions, coupled with new export controls on graphite by China, are prompting a closer examination of the recycling potential of this carbon-based mineral.

Navigating Challenges in the Battery Anode Supply Chain

China’s implementation of export controls on graphite, a crucial component of commercial EV battery anodes, has triggered concerns among U.S. lawmakers. With China’s dominance in the entire battery anode supply chain, from mining to manufacturing, U.S. automakers are now exploring alternative sources, including domestically sourced graphite.

Graphite Recycling Initiatives

In response to the urgent need for alternative sources of graphite, U.S. battery recyclers are exploring a unique avenue: recycling graphite from spent batteries. The Department of Energy’s substantial investment in graphite recycling initiatives aims to overcome technical and economic barriers. Now we see how these initiatives could potentially offer a faster solution than establishing new graphite mines, contributing to a more sustainable and domestically sourced graphite supply.

Technical Challenges of Graphite Recycling

To comprehend why graphite recycling poses a challenge, a brief exploration into material science is essential. It elucidates the properties of graphite that make its recycling complex, including its dual metallic and non-metallic characteristics. Understanding the charging and discharging processes in lithium-ion batteries sheds light on the role graphite plays and the difficulties in separating and purifying it for reuse.

Recycling Approaches: Opportunities and Obstacles

In navigating the complexities of recycling graphite, this article delves into the diverse approaches that industry pioneers are undertaking. Traditionally, pyrometallurgy, involving the smelting of batteries in a furnace, has been a common method. However, it emphasizes the limitations of this approach for graphite due to the risk of burning off the material. As the battery recycling industry evolves, there is a discernible shift towards hydrometallurgical processes, where dead batteries are shredded and dissolved in chemical solutions to extract and purify metals. While chemical extraction methods are adaptable for graphite purification, logistical challenges persist.

It also explores the innovative concept of direct recycling, a process that separates and repairs battery materials without smelting or acid treatment. Although still in the early stages of development, direct recycling holds promise for retaining the original structure of materials, potentially reducing energy consumption compared to synthetic graphite production. By dissecting these methods, the article navigates through the opportunities and obstacles that underscore the evolving landscape of graphite recycling technologies, offering insights into their potential benefits, environmental considerations, and scalability.

Industry Initiatives and Future Prospects

Highlighting the efforts of companies such as American Battery Technology Company, Ascend Elements, and Princeton NuEnergy, this section delves into the ongoing research and development in graphite recycling. While some companies are already recycling graphite at a small scale, the article explores the challenges they face and the Department of Energy’s role in funding initiatives that aim to propel recycled graphite into commercial viability. The potential benefits of recycled graphite in reducing waste and carbon emissions are also discussed.

Future of Graphite Recycling

In envisioning the future trajectory of graphite recycling, this conclusion underscores its far-reaching implications within the electric vehicle (EV) industry. The discourse extends beyond the immediate challenges and opportunities presented by recycling methods to explore the overarching impact on the entire EV supply chain. Central to this exploration are the significant roles played by tax incentives and critical material classifications, both pivotal factors shaping the future of sustainable battery solutions.

As governments increasingly prioritize environmentally conscious policies, tax incentives become instrumental in encouraging the adoption of domestically recycled graphite. The article delves into the evolving tax credit requirements, emphasizing how meeting these stringent criteria could position recycled graphite as a premium component in the marketplace. Furthermore, the critical material classifications of graphite, particularly its inclusion in the Department of Energy’s list of vital materials for energy, accentuates its strategic importance.

With a keen focus on sustainability, the article contemplates the evolving landscape of graphite recycling’s contribution to a more efficient and environmentally responsible EV battery supply chain. This final section aims to inspire reflection on the transformative potential of graphite recycling, not merely as a solution to immediate challenges but as a cornerstone in shaping a sustainable and resilient future for the rapidly advancing EV industry.